Table of Content

Your queries on Hdfc Bank personal loan closure letter is readily available in this blog post. Also in case of insurance claims the money would be paid to the lender only. Therefore, you are kindly requested to close my loan account.

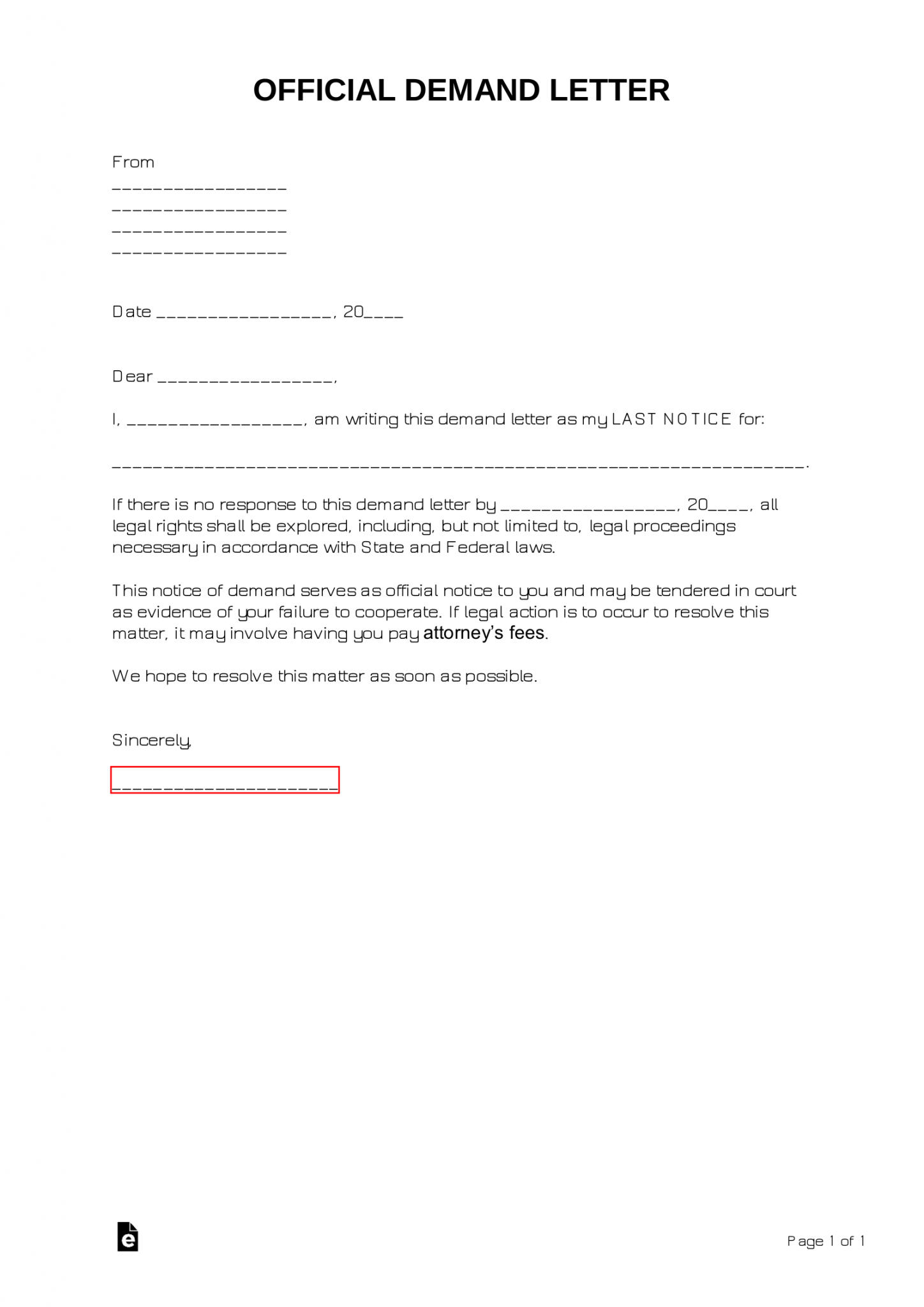

A NOC stands for no objection certificate which is a legal document provided after the settlement of a loan account. It is provided by the lender to the borrower. You can foreclose your personal loan by contacting the HDFC Bank branch from which you obtained it. I am writing to request that you please close my home loan and issue all necessary documents. You may be asked to fill out a form or write a letter requesting the pre-closure of your Personal Loan account.

Disbursement Process

I've attached all the necessary documents as per your demand. If any additional information or documents are required, please let us know. Form-35 is sent by post along with the loan closure letter for all the eligible loan accounts within a maximum of 15 working days. You cannot close HDFC Bank personal loans online. Individuals must visit an HDFC Bank branch to complete the personal loan.

The amount of NOC charges varies on the basis of loan type. Mention the subject line of your application as "Request for Personal Loan Closure." Second, make sure to address your letter to the Branch Manager. Include a variety of contact information so that they can reach you if they have any further questions. Make sure you explain why you're closing the account. Finally, end the letter with letter closings like sincerely or regards.

Available Formats

If you have already paid the balance loan amount then you have to mention the payment details on the foreclosure letter. The details are like amount paid, payment mode, date, copies of bill receipts. If you paid through cheque then mention the cheque number and date. Here I request you to kindly let me know the remaining loan amount which I have to pay to foreclose my loan and also the procedure of loan foreclosure in your bank. A NOC is obtained by the bank after the settlement of a loan, which means that there is no outstanding amount that needs to be settled.

I'm capable and passionate to provide you with high-quality materials for all sorts of Letter automating routine tasks on this site. This article's contents are for informational purposes only and do not reflects legal advice or opinion. They are the author's honest perspectives. In case of full disbursement, your EMI payments may start from the month following the month in which the full disbursement has been made . Based on previous steps, the application gets accepted or rejected by the Authority. Your browser will redirect to your requested content shortly.

How to get a Duplicate NOC Online?

I'd like to pay off my entire loan balance in one payment, so please walk me through the process of pre-closing my personal loan. I have cleared all the outstanding loan amount of Rs. ______________ through net banking on , please find the payment receipt enclosed with this letter. After paying all the installments, ask your bank for a no-objection certificate . This document will state that there is no outstanding amount on this account number. The bank will send the NOC to you by post within 15 working days. The customers of HDFC Bank can also get the NOC on NetBanking through the website and also via the mobile app.

Loan foreclosure/pre-closure means you are ready to pay the remaining loan amount in a single payment even before the tenure date. My name is , currently have a home loan in your bank bearing loan a/c no. ___________. I would like to foreclose my home loan this month by paying the outstanding amount in a single payment.

Then, using the application samples provided below, write loan closure letter to HDFC bank. I am looking forward to foreclosing my home loan this month but I don’t know the procedure. So please guide me on how to foreclose my loan and I am ready to pay the foreclosure charges. I have paid off my outstanding loan balance online, and please see the enclosed loan payment receipt with this letter. These charges vary from one bank to another bank, here is the list of loan foreclosure charges in different banks.

I hereby declare that the information furnished above are true and correct to the best of my knowledge and belief. Applicant needs to submit below mentioned documents to the Authority. Sanction Letter gives the indication that the application has been accepted, processed, and verified. Checking your browser before accessing

Give your contact details at the end of the letter. You have invested your own contribution in full (i.e. made the down payment). I hereby give my consent and authorise HDFC Sales Pvt. Ltd. and its affiliates to call / email / SMS me in relation to any of their products.

Let me first tell you that in order to close an loan in HDFC Bank where you obtained your loan, you must carefully follow and read their terms and conditions. I am aware of the applicable loan foreclose charges. In case of partial disbursement, you may need to pay ‘pre-EMI’ interest till full disbursement is made after which EMI payment starts. The lender will consider only the construction stage and not any instalment payment timelines stipulated by the builder. Submit the required documents in the original and self-attested copy. In case you're not familiar with the HDFC Personal Loan Closure Letter Format, I urged you to read thisblog post carefully.

Therefore we hereby request you to kindly close your home loan and issue us all the required documents. Now we want to foreclose our home loan, and we paid the outstanding loan amount of _______ Rs by cheque bearing cheque no. _____________ dated ______. IRDAI is not involved in activities like selling insurance policies, announcing bonus or investment of premiums. Public receiving such phone calls are requested to lodge a police complaint. Once the loan has been fully settled/closed, the NOC is sent by the bank to the borrower’s registered address and registered mail as well.

No comments:

Post a Comment